Life Insurance

The Life Insurance Advantage

- Comprehensive coverage: Protect your family’s financial future with plans suited to your life stage.

- Flexible options: Choose between term life or permanent insurance based on your long-term objectives.

- Affordable premiums: Budget-friendly policies designed to deliver maximum value.

- Personalized guidance: Work with a trusted advisor to select the best plan for you.

Combined with expert advice and a clear understanding of your goals, life insurance ensures a secure tomorrow while offering benefits you can enjoy today.

Our Life Insurance Options

Flexible Term Life Plans

Term Life Insurance provides affordable protection for a specific period, making it ideal for families seeking financial security during critical years. It offers a straightforward way to safeguard your loved ones from unexpected financial burdens.

With a duration ranging from 10 to 30 years, Term Life Insurance empowers you to:

- Provide for your family in case of unforeseen events.

- Cover major expenses, such as mortgages or education.

- Enjoy peace of mind knowing your loved ones are protected.

Term Life Features:

Affordable premiums: Lower costs compared to permanent life insurance.

Customizable terms: Choose a coverage period that fits your family’s needs.

Quick and easy setup: Get covered without complex processes.

Reliable protection: Ensure financial security for your dependents during the policy’s term.

Guidance included: Receive personalized advice to choose the best term and coverage.

Interested in Term Life Insurance?

Contact us to determine the right plan for your goals:

Permanent Life Insurance

Lifetime Financial Security

Permanent Life Insurance is a long-term solution that provides lifelong coverage and builds cash value over time. Perfect for individuals seeking to protect their family while also investing in their financial future.

With Permanent Life Insurance, you can:

Enjoy lifelong protection.

Access cash value for emergencies or opportunities.

Create a legacy for future generations.

Permanent Life Features:

Cash value accumulation: Build equity you can use for any purpose.

Flexible options: Choose between whole life or universal life policies.

Tailored to your goals: Adjust coverage as your life evolves.

Comprehensive support: Receive ongoing guidance to optimize your plan.

Interested in Term Life Insurance?

Contact us to discover how this solution fits your needs:

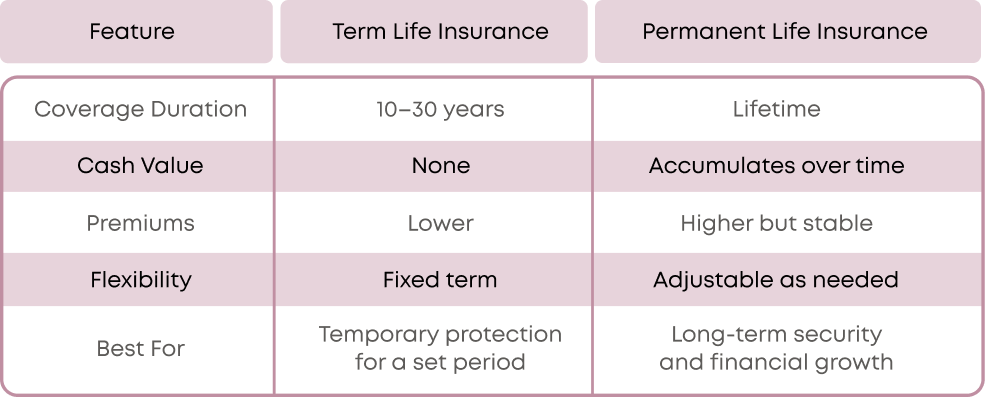

Compare Products

Feature

Term Life Insurance

Permanent Life Insurance

Coverage Duration

10–30 years

Lifetime

Cash Value

None

Accumulates over time

Premiums

Lower

Higher but stable

Flexibility

Fixed term

Adjustable as needed

Best For

Temporary protection for a set period

Long-term security and financial growth

Which One to Choose?

Term Life Insurance: Ideal for families seeking affordable, short-term protection for specific needs like paying off a mortgage or funding education.

Permanent Life Insurance: Best for individuals looking for lifelong security with added financial benefits, such as cash value growth and estate planning.